Vancouver mortgage broker perspective

Before I begin, I would like to give thanks to Bobby for allowing me to write this guest column on his website and to share my message with a new audience. I think it is helpful to get different viewpoints when considering such a large purchase as buying a home, and as a mortgage broker in Vancouver, I am able to provide a unique perspective on the market.What is happening in the real estate market?

Being a mortgage broker in Vancouver has given me a different viewpoint of the market compared to a realtor, as I am more versed with numbers than a typical Realtor©. The statistics as it stands are indicative of a slow-down in the housing market. It is early right now, and it remains to be seen whether or not this is going to be a prolonged correction of the housing market, or whether it will pick up again within the next few months. Or a bit of both. The trend, in my opinion, is looking downwards. More on that shortly.The housing market cycle

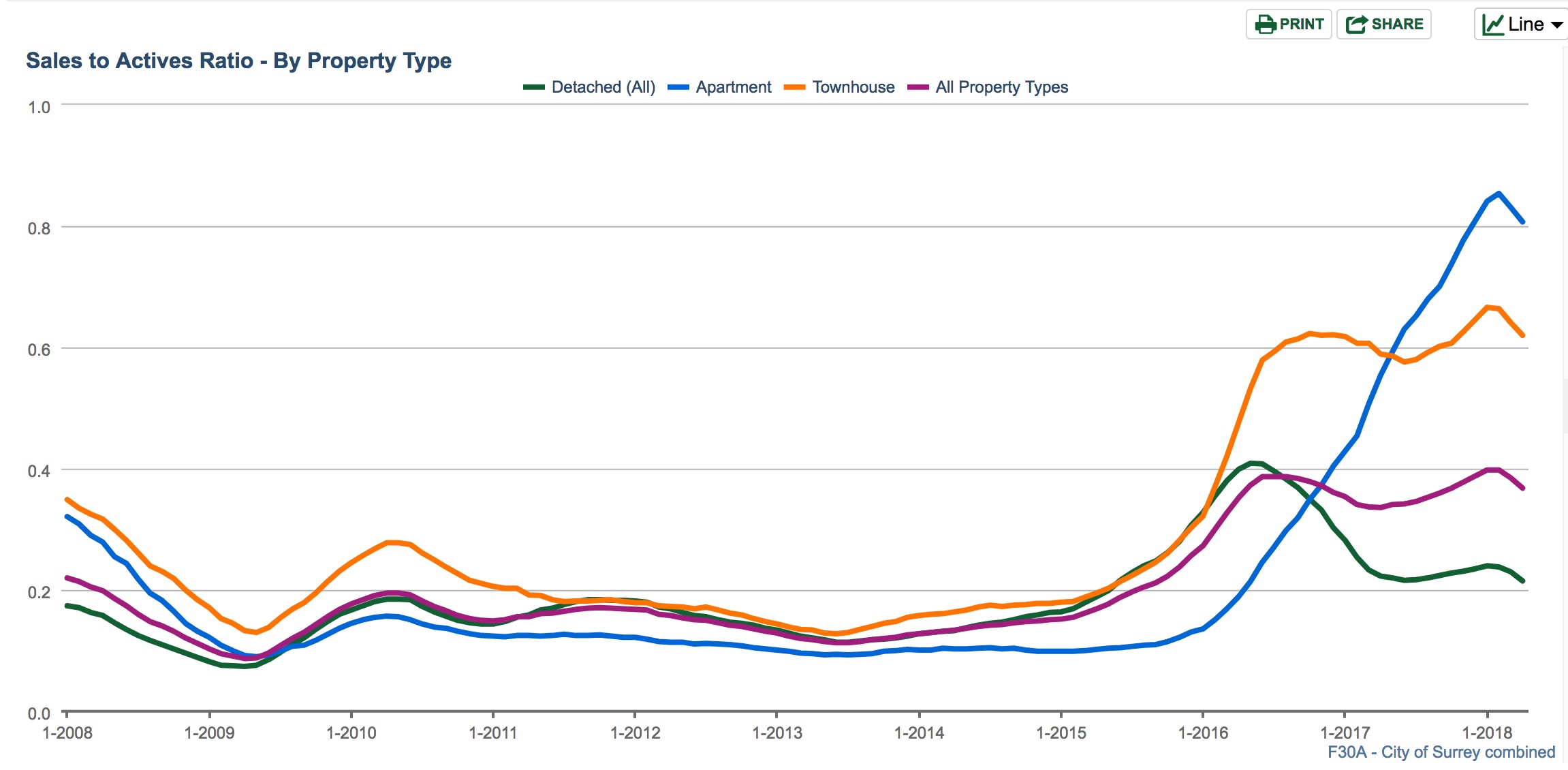

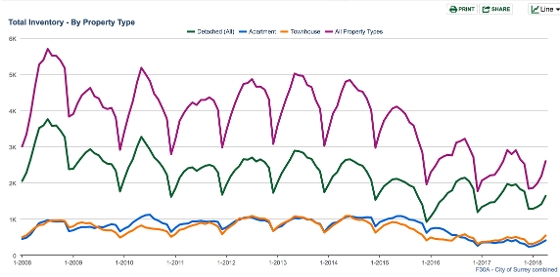

Why would it pick up in the months to come, but still be indicative of a correction? It is because there is an annual cycle of hot and cold within a year. The quietest month of the year for real estate is December, and the market gradually heats up as the spring approaches where it reaches its peak in May-July of each year before slowing down again. You can see that in the graph below. It is a representation of the last 10 years of statistics for the real estate market in Surrey. So, depending on the time of year, you are likely to see a hotter, or a colder market than at another time of year, but it does not mean that the market has changed.

The one (or two) graphs that says it all

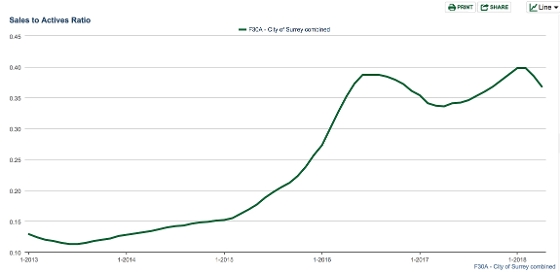

This is sales to active listings graph for Surrey real estate with a rolling 12 month average.

It shows the market picking up dramatically from about January 2015 through August 2016 at which point the BC government introduced the foreign buyers tax, after which it has been relatively flat. No cause for worry, right? Look at this:

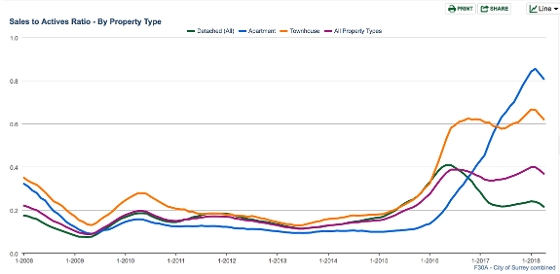

This is the same graph for Surrey, but broken down by property type. The blue line represents condominiums. The green is detached houses. Detached houses peaked in June 2016 and went on a major slide shortly afterward (foreign buyers tax?). But they did not recover. Prices went up, but the hot market is was gone. The blue line started a massive incline in January 2016, reaching its apex in February 2018. It is now starting to decline for the first time in years. It has been increasing for over two years, but for many years before that, it was flat, not decreasing or increasing. Also, notice that since January 2016, the only market segment that was increasing in demand was the condo market. Everything else was relatively flat. Now, since February, all segments are now down. I think prices could possibly still go up a little in the short term, and condos should still see some price growth, but all the segments are now going down in demand. I believe this to be the top of the market. Why do I feel this way?

What changed in the Greater Vancouver housing market?

In January of 2017, the federal government introduced a new "stress test" that impacted insured mortgages, and also introduced other measures to cool the housing markets of Vancouver and Toronto. In January 2018, the government expanded this to include all mortgages, regardless of the amount of down-payment. This had the effect of decreasing the qualification of borrowers by around 20%, and many of them were going for as much as they could in order to buy what they needed. Interest rates have also been on a continuous upward climb since the beginning of 2016, where I could get a 5 year fixed rate at 2.29%. The latests 5 year fixed rates are in the 3.2-3.7% range. Beyond the stress test limiting qualification, this increase has a real world impact on housing affordability. Why else do I feel we are now at the top of the market? Simply put, the ability of average residents of Vancouver to own property is near its maximum. The Surrey median income in the last census was $77,494. For 2018, lets add 8% to that, and estimate it to be $83,693. Assuming they have credit scores over 680 and not a lot of debt, and subtracting property tax, heat and strata fees, the maximum mortgage payment that the "stress test" would qualify for is $2,303/month. That supports a mortgage amount of approximately $380,000. The average apartment in April 2018 benchmark was $466,000 for Surrey, one of the most affordable regions in Greater Vancouver. This means the average person in Surrey, to buy the average apartment in Surrey, will need approximately 20% down in order to get into the market. I think there are many other factors in play, like under the table income people may receive, or getting assistance with the downpayment from relatives, etc, but for many people, that puts home ownership out of reach, and many others are going to be strained to meet this.Obeservations

Ultimately, it is up to each individual to determine what is best for them to do, and this is not legal advice and you assume responsibility for your actions. However, my thoughts on the market are:- If you are considering selling your home soon, this is a good time to do so. Get the best offer you can get and sell.

- If you are selling and then buying, its to your advantage if you are moving up, as the detached and townhouse markets are already significantly cooler than the condo market.

- If you are happy with where you are living, and you plan to be there for a while, you can likely wait out any market correction.

- If you are planning on buying a home, this could be one of the best opportunities to get into the market that you have had in at least 2 years.

- I would not be comfortable flipping properties in this market.

- I feel that detached houses will be the hardest hit segment of a correction, and will be the first segment that gets hit.